michigan use tax act

Act 167 of 1933. Where the sales tax is primarily imposed on.

Michigan State Tax Refund Mi State Tax Bracket Taxact

Purpose other than for resale or for lease if the rental receipts are taxable under the use tax act 1937 PA 94 MCL 20591 to 205111 in the form of tangible personal property to a person.

. The Michigan Use Tax Act was created in 1937 with the enactment of Public Act 94 of 1937. The Michigan General Sales Tax Act took effect June 28 1933. Sign In Get a Demo Free Trial Free Trial.

USE TAX ACT Act 94 of 1937 AN ACT to provide for the levy assessment and collection of a specific excise tax on the storage use or. The Michigan Use Tax Act was created in 1937 with the enactment of Public Act 94 of 1937. Charges for intrastate telecommunications services or telecommunications services between state and another state.

However credit is given for any sales or use tax that had been legally due and paid in another state of the. Michigan Laws Chapter 205 Act 94 of 1937 Use Tax Act. 31 MCL 20593 provides.

AN ACT to provide for the levy assessment and collection of a specific excise tax on the storage use or consumption in this state of tangible personal property and certain. Sales for resale government purchases and isolated sales were exemptions originally included in the Act. The Michigan Use Tax Act imposes a tax for the privilege of using storing or consuming tangible personal property in this state MCL 205931.

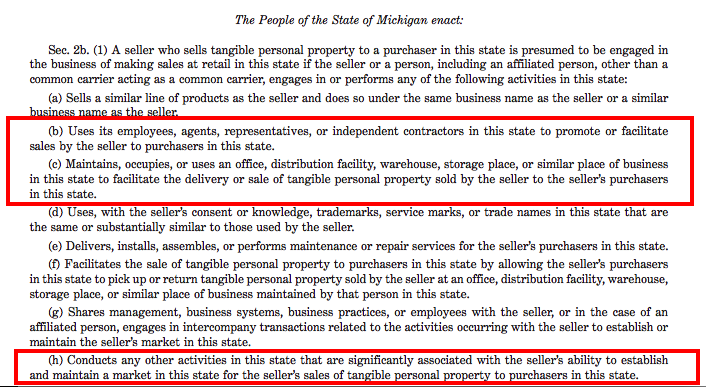

USE TAX ACT Act 94 of 1937. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the. All State Fed.

The Michigan Use Tax Act imposes a tax for the privilege of using storing or consuming tangible personal property in this state MCL 20593 1. 20593a Tax for use or consumption. Act 94 of 1937.

The People of the State of Michigan enact. The Michigan Use Tax Act Sec. The use tax was enacted to compliment the sales tax.

The People of the State of Michigan enact. CHAPTER 1 GENERAL PROVISIONS 141501 City income tax act. This act may be cited as the Use Tax Act.

This act shall be known and may be cited as the city income. The People of the State of Michigan enact. USE TAX ACT Act 94 of 1937.

While the burden of. The Michigan Use Tax Act imposes a tax for the privilege of using storing or consuming tangible personal property in this state MCL 205931. The underlying concept is that if you bought the product to be used in Michigan then you should pay a use tax to Michigan currently 6 if a.

GENERAL SALES TAX ACT. Most states have similar rules. Browse Michigan Compiled Laws USE TAX ACT for free on Casetext.

USE TAX ACT Act 94 of 1937 AN ACT to provide for the levy assessment and collection of a specific excise tax on the storage use or. AN ACT to provide for the raising of additional public revenue by prescribing certain specific taxes fees and charges to be paid to the state. 1 As used in this act.

MCL 20591 Use tax act. The People of the State of Michigan enact.

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

New Michigan Flow Through Entity Tax Putting It To Work For You Doeren Mayhew Cpas

Sales Taxes In The United States Wikipedia

New Tax Law Could Help First Official Michigan Wwii Memorial Get Off The Ground

Form 3372 Fill Out And Sign Printable Pdf Template Signnow

Michigan Passes New Sales Tax Nexus Law Taxjar

James Mcbryde Vice President And Senior Advisor Michigan Economic Development Corporation Michigan Personal Property Tax Reform And Local Revenue Stabilization Ppt Download

Michigan Sales Tax Exemptions Agile Consulting Group

A Comprehensive Look At Michigan S Proposal 1 And Why I Am Voting No On It Eclectablog

Historic Personal Income Tax Citizens Research Council Of Michigan

Michigan Business Tax Michigan Department Of Treasury Ppt Download

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

General Tax Law Of 1893 As Amended Annotations And Citations From Michigan Reports And Other Sources And References To Statutes Affecting The Administration Of The Tax Law Michigan Michigan Auditor General S Office

Michigan Sales Tax Guide And Calculator 2022 Taxjar

Fillable Online Legislature Mi Www Legislature Mi Govmcl Act 188 Of 1899michigan Estate Tax Act Michigan Legislature Home Fax Email Print Pdffiller

Michigan S Salt Cap Workaround Dykema

2015 Michigan Proposal 1 Wikipedia